Case Study: Hedging Oil Price Exposure As An E&P#

import pandas as pd

import numpy as np

import plotly.io as pio

from IPython.display import display

import warnings

# import hedging functions

import brent_hedging_functions as hf

warnings.filterwarnings("ignore")

pio.templates.default = "plotly_white"

pd.set_option("display.max_columns", None)

COMDTY_CODES = {"brent": "CB"}

# cme month codes dict

cme_month_codes = {

1: "F",

2: "G",

3: "H",

4: "J",

5: "K",

6: "M",

7: "N",

8: "Q",

9: "U",

10: "V",

11: "X",

12: "Z",

}

Introduction to OptiQuant Analytics#

OptiQuant Analytics is a finance and strategy consultancy specializing in the upstream energy sector. We focus on developing financial models and data analytics frameworks to support risk management, capital allocation, and strategic decision-making for companies and investors in the energy space.

Clients & Industry Focus We primarily work with:

Oil & Gas Producers

Also known as Exploration & Production (E&P) companies or upstream operators.

These firms extract, process, and sell crude oil, natural gas, and natural gas liquids (NGLs).

Private Equity Firms

Investors that own, acquire, or manage upstream energy companies.

Require robust financial models for valuation, risk assessment, and capital allocation.

Core Areas of Expertise We apply quantitative finance, risk modeling, and economic analysis to help upstream energy firms make data-driven financial decisions. Our key areas of focus include:

Corporate Hedging Advisory & Risk Modeling

Structuring and evaluating commodity hedging strategies

Assessing hedge effectiveness and risk exposure

Data Modeling, Integration & Analytics

Automating financial and operational data workflows

Developing analytical tools for market and company-level insights

Financial Strategy & Capital Allocation

Evaluating investment opportunities and capital structuring

Scenario modeling for debt, equity, and cash flow planning

Corporate Valuation & Cash Flow Modeling

Building financial projections for M&A, fundraising, and strategic planning

Quantifying the impact of commodity price fluctuations on valuation

Macroeconomic & Market Analysis

Assessing trends in interest rates, inflation, and economic cycles

Understanding supply, demand, and pricing dynamics in global energy markets

Background & Experience

15+ Years in finance, energy, and investment strategy:

Energy Investment Banking (5 years): Focused on M&A, capital markets, and financial advisory at Morgan Stanley and Jefferies

Private Credit & Structured Investments (3 years): Generalist private credit investing at Deerpath Capital Management and Crestline Investors

Upstream Energy Finance Leadership (4 years): VP of Finance at Triple Crown Resources, a private equity-backed upstream operator

Financial Analytics & Decision Support (3 years): Developing financial models & strategic tools for energy firms at OptiQuant Analytics

Education

🎓 BA in Mathematical Economic Analysis – Rice University (2010)

🎓 MS in Financial Mathematics – University of Chicago (2024)

Case Study: Hedging Oil Price Exposure As An E&P#

What is an “E&P”?#

Exploration and production businesses in the oil and gas sector are companies that extract oil and gas from the ground, and sell these commodities to the market. Extraction is via the drilling and operation of oil and gas wells. Also called “upstream” companies.

Employ a broad range of skillsets (PhDs/Engineering masters for scientific and geological work, MBAs / finance for management, GEDs or simply years of experience for “on-the-ground” field work).

Capital-intensive businesses, challenging to operate for a variety of reasons, but can be very lucrative for shareholders if growth and financial risk are managed well.

Financial risk \(\rightarrow\) probability of loss of investment. For E&Ps, this investment risk arises from large minimum capital investment required to drill and operate an oil or gas well:

Seismic and geological studies of an area to assess how much oil and gas exists underground can cost anywhere from $200k - $2 million+, depending on the complexity.

Drilling a single oil or gas well can cost $5mm - $25mm onshore US, spent over several months. Offshore oil and gas wells can cost $150 million+ (these are considered capital expenditures).

Beyond this, there are operating costs, initial processing costs for the company, as well as pipeline or truck transportation expenses.

Due to the asset-heavy nature of these businesses, they can typically raise leverage from banks (and more recently, credit funds). Managing this leverage effectively requires a business skillset.

Furthermore, the business sells its products at a price reflective of commodity futures markets (with each of oil, natural gas, etc. comprising a separate market, each with its own dynamics).

Primary Business Objectives#

Grow cash flow via higher production of oil, gas, and NGLs (ethane, propane, butane, natural gasoline).

Minimize the risk around future cash flows by de-risking key business areas (geological, financial).

Increase net asset value (equity value)—typically a byproduct of executing the first two objectives well.

Essentially, the E&P management team is trying to maximize the Risk-Adjusted Return on Capital (RAROC) for their investors.

In other words, they aim to maximize expected future cash inflows while minimizing the risk around those future cash inflows.

Maximizing RAROC is essentially a business equivalent of maximizing the “Sharpe Ratio” of an investment portfolio!

Sharpe Ratio for a Portfolio (Reminder)

A higher Sharpe Ratio indicates better risk-adjusted performance. The Sharpe Ratio is defined as:

where:

\( R_p \) = Expected portfolio return

\( R_f \) = Risk-free rate

\( \sigma_p \) = Standard deviation of portfolio returns

Risk-Adjusted Return on Capital (Business)

A higher RAROC indicates better risk-adjusted business performance.

Primary Source of Revenue Risk: Commodity Prices#

OptiQuant helps clients reduce uncertainty around Equation (3):

Defining The Corporate Hedging Problem: How To Reduce Price Risk (Where Revenue = Price x Volume)#

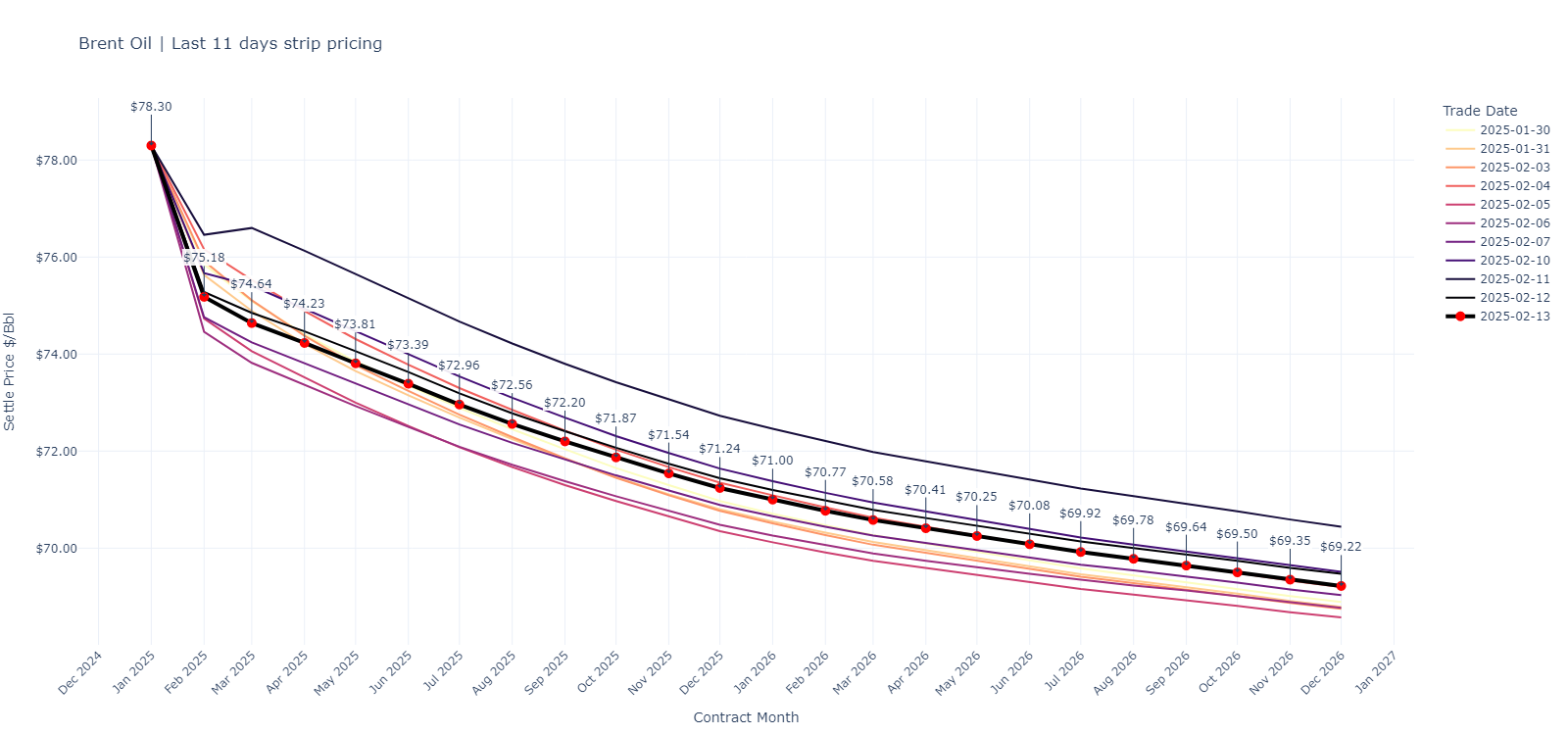

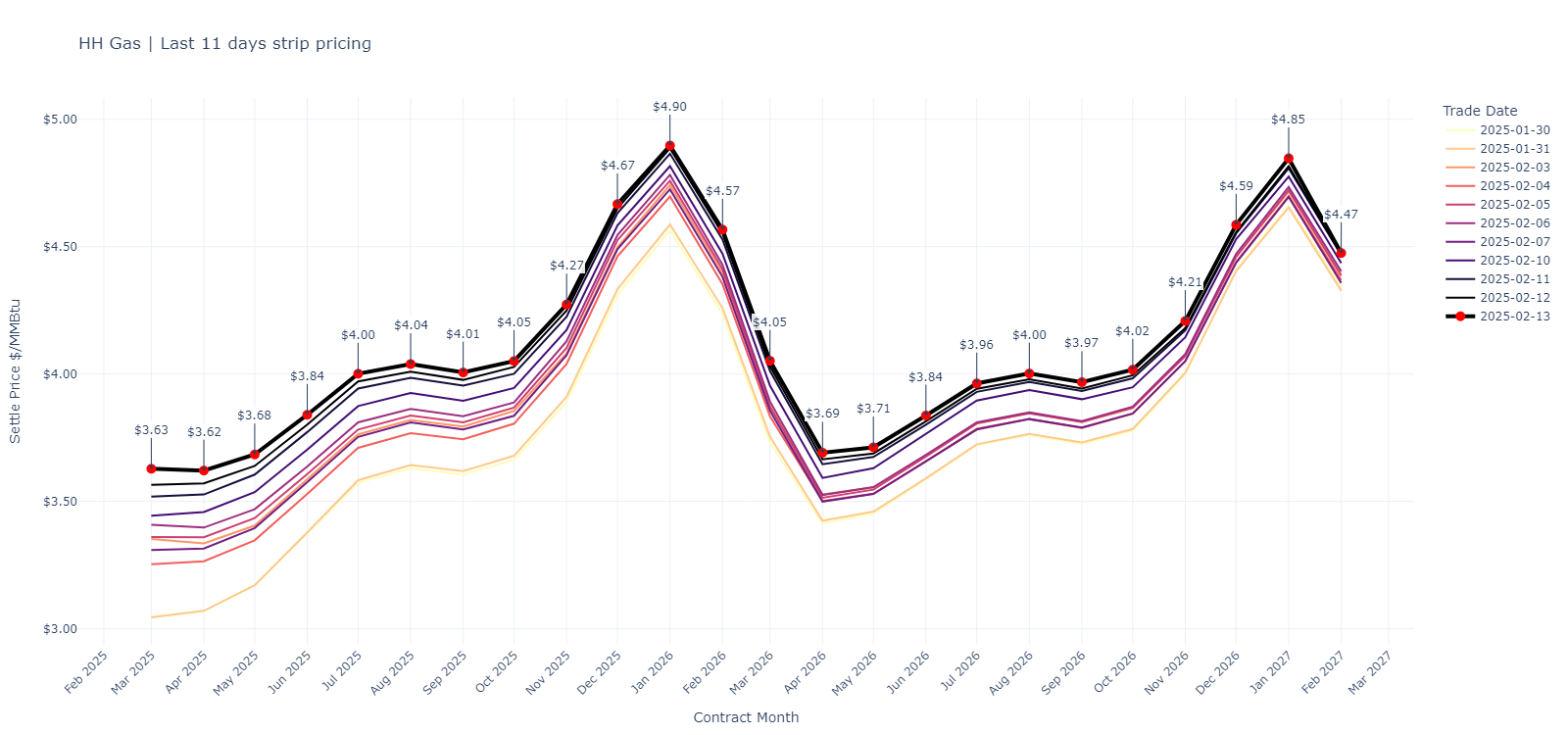

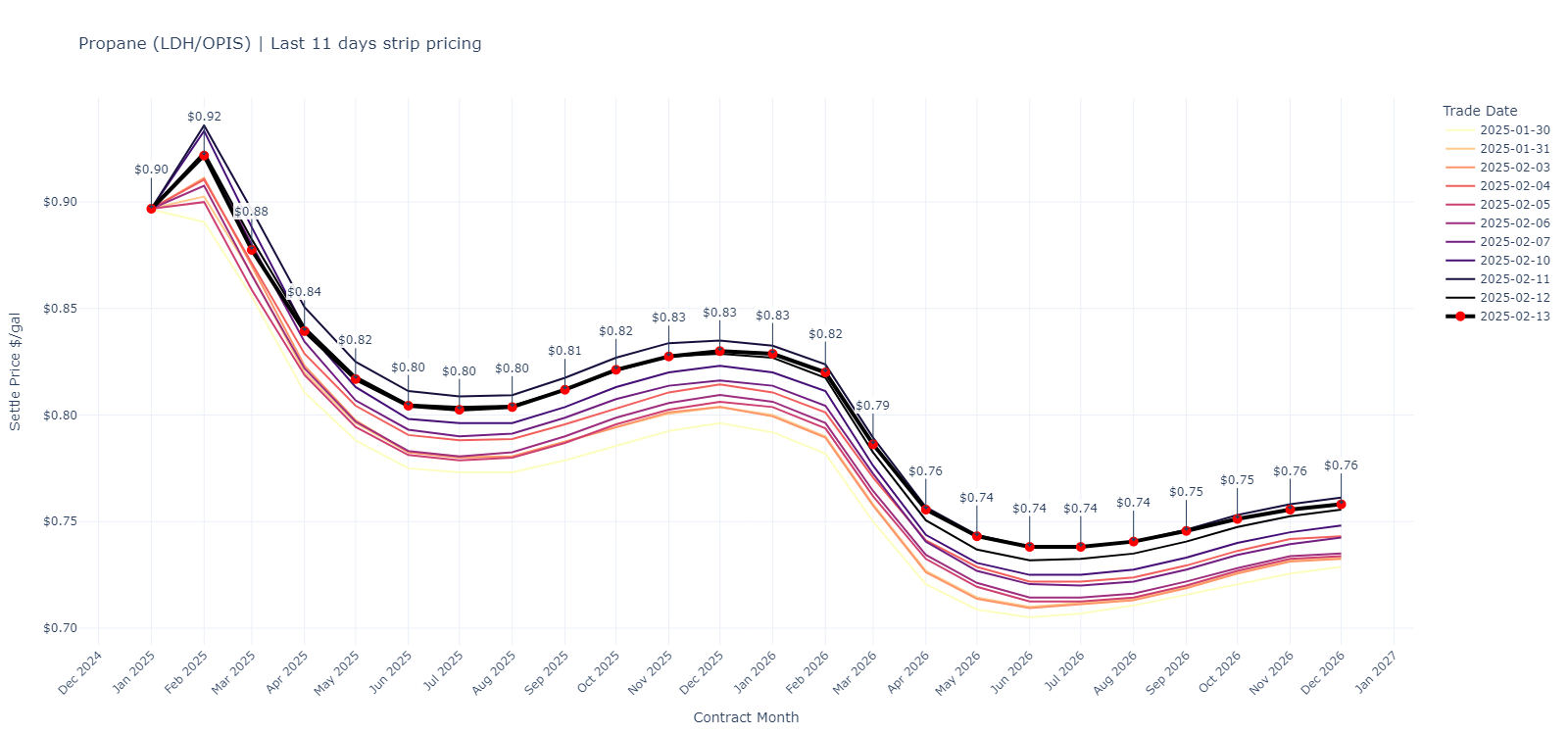

The challenge is captured in Equation (3) and the futures term structure below (for Brent oil, Henry Hub natural gas, and Propane, a natural gas liquid/NGL)

Managing Revenue Risk Via Hedging#

E&Ps have a natural long exposure to oil, natural gas, and NGL prices: Their (unhedged) revenue is therefore stochastic and subject to factors influencing oil and gas prices, including:

Supply, demand, storage

Geopolitics

Interest rates

Speculative interest

Hedging tools include:

Calls

Puts

Fixed price swaps

(Rarely) Exotic structures

Many hedging decisions are made without fully considering the underlying statistical properties of the commodities being hedged.

Benefits of Risk Management#

Attract greater capital investment \(\rightarrow\) investors prefer companies demonstrating superior financial risk management.

Stronger IPO potential \(\rightarrow\) public investors seek companies with predictable multi-year cash flows.

Higher valuation multiples (P/E ratios) \(\rightarrow\) companies with higher RAROC command higher premiums in financial markets.

Increased wealth for employees and shareholders

This Lecture:#

☐ 1. Model an E&P as a long position in Brent oil futures (CME: CY).

☐ 2. Work with real option prices & futures data for Brent oil.

☐ 3. Use option delta to approximate the probability of an option expiring in-the-money.

☐ 4. Use option delta to define acceptable risk ranges for the hedging program (e.g., 80% probability of options expiring worthless).

☐ 5. Design a hedging strategy to lock in a price floor for oil using put options.

☐ 6. Attempt to make the hedge costless by selling call options (i.e., constructing a costless collar).

☐ 7. Validate option pricing models using Monte Carlo simulation of Brent futures with implied volatility.

Homework Assignment:#

Replicate this exercise for SPX options.

A Brief Review Of The Option Market and Option Pricing#

! Important !

Model Inputs for Option Pricing#

The underlying security’s current price (Brent, in this case) → Known / observable.

The option strike price → Chosen by the investor; market makers provide quotes for commonly used strikes.

Time to maturity → Chosen by the investor; Brent options are typically quoted in monthly maturities.

The risk-free rate → Observable (commonly estimated using U.S. Treasuries of similar maturity).

The implied volatility → Not observable; it is inferred from market prices by solving the BSM equation.

All inputs to the BSM model are known or observable in the market, except for one: implied volatility (which must be inferred from market prices).

Call Options#

Can buy or sell call options for a price (determined by the market; also called the option “premium” or “cost”).

Option prices vary based on current Brent price level, and future expectations of movement.

Investor chooses strike price, time to expiry (contract maturity), and whether to buy (go long) or sell (short) the call option.

If Brent price at expiry > strike price, a call option is in-the-money (“ITM”), and the buyer receives (Brent – strike) at settlement.

Net of upfront cost, the call option buyer’s Payoff = (Brent – strike) – upfront cost.

If Brent price at expiry <= strike price, a call option is out-of-the-money (“OTM”), and expires worthless.

The call option buyer’s Payoff = – upfront cost \(\rightarrow\) The buyer loses the amount paid for the option.

Black-Scholes Formula For European Call Option Pricing#

where:

\(S\) = Price of underlying

\(K\) = Option strike price

\(\Phi(.)\) = CDF of Standard Normal Distribution

\(\sigma\) = Implied volatility (IV) of the underlying asset

\(r\) = Risk-free rate

\(T\) = Time remaining to expiry

\(d_1 = \frac{\ln\left(\frac{S}{K}\right) + \left(r + \frac{\sigma^2}{2}\right)T}{\sigma \sqrt{T}}\)

\(d_2 = d_1 - \sigma \sqrt{T}\)

Call Option Payoff at Expiry#

|

call_payoffs = hf.show_call_option_payoff(S=80, K=90.25, sigma=0.2744, r=0.045, T=0.5)

Put Options#

Same as call options:

Can buy or sell put options for a price (determined by the market; also called the option “premium” or “cost”).

Option prices vary based on current Brent price level, and future expectations of movement.

Investor chooses strike price, time to expiry (contract maturity), and whether to buy (go long) or sell (short) the put option.

Different from call options:

If Brent price at expiry < strike price, a put option is in-the-money (“ITM”), and the buyer receives (strike – Brent) at settlement.

Net of upfront cost, the put option buyer’s Payoff = (strike – Brent) – upfront cost.

If Brent price at expiry >= strike price, a put option is out-of-the-money (“OTM”), and expires worthless.

The put option buyer’s Payoff = – upfront cost \(\rightarrow\) The buyer loses the amount paid for the option.

Black-Scholes Formula For European Put Option Pricing#

where:

\(S\) = Price of underlying

\(K\) = Option strike price

\(\Phi(.)\) = CDF of Standard Normal Distribution

\(\sigma\) = Implied volatility (IV) of the underlying asset

\(r\) = Risk-free rate

\(T\) = Time remaining to expiry

\(d_1 = \frac{\ln\left(\frac{S}{K}\right) + \left(r + \frac{\sigma^2}{2}\right)T}{\sigma \sqrt{T}}\)

\(d_2 = d_1 - \sigma \sqrt{T}\)

Put Option Payoff at Expiry#

|

put_payoffs = hf.show_put_option_payoff(S=80, K=75, sigma=0.2744, r=0.045, T=0.5)

The Costless Collar: A “Free” Floor on Oil Prices#

collar_payoff = hf.build_costless_collar(

put_payoffs, call_payoffs, put_strike=75, call_strike=90.25

)

collar_payoff = hf.add_S_payoff(collar_payoff, S0=80, name="Brent")

Observation 1: Locking in the floor is a dynamic decision. Why?

Observation 2: A high floor is a contradictory objective with a high ceiling price. Why?

Question 1: How Do We Know What Strikes / Expiries To Hedge?#

(Partial) Answer: We need some estimate of the probability of the underlying price crossing the call or put strikes (i.e. the prob. of the option expiring in-the-money, \(P_{ITM}\)).

Question 2: Is There A Metric That Allows Us To Estimate This Probability, Based on Option Prices?#

Quick Answer: Yes - the option delta is a good estimate.

Less Quick Answer: Yes - \(\Phi(d_2)\), which is the risk-neutral probability of an option expiring ITM.:

But:

it’s a bit more involved to calculate,

call and put deltas are freely available from many data providers,

\(\Phi(d_2)\) is typically fairly close to \(\Phi(d_1)\), particularly for options near-the-money or close to expiry (\(T\rightarrow 0\)),

We can approximate \(\Phi(d_2)\) with a first-order Taylor approximation of \(\Phi(.)\), since we know the value of the call option delta \(\Phi(d_1)\) (and of course, the put option delta \((\Phi(d_1) - 1)\)

…and if you really want to know the relationship:

For the rest of this lecture and the homework assignment, we will assume the option delta is an estimate of the probability of that option expiring ITM.

Option Deltas#

Call Option Delta: Measures the sensitivity of the call option’s price to changes in the stock price. It ranges from 0 (deep out-of-the-money) to 1 (deep in-the-money).

Put Option Delta: Measures the sensitivity of the put option’s price to changes in the stock price. It ranges from -1 (deep in-the-money) to 0 (deep out-of-the-money).

Call Option Delta#

1. Call Option Price

where:

\(S\) = Price of underlying

\(K\) = Option strike price

\(\Phi(.)\) = CDF of Standard Normal Distribution

\(\sigma\) = Implied volatility (IV) of the underlying asset

\(r\) = Risk-free rate

\(T\) = Time remaining to expiry

\(d_1 = \frac{\ln\left(\frac{S}{K}\right) + \left(r + \frac{\sigma^2}{2}\right)T}{\sigma \sqrt{T}}\)

\(d_2 = d_1 - \sigma \sqrt{T}\)

2. Identify Terms Dependent on \( S \)

\( S \Phi (d_1) \): Directly depends on \( S \) since \( S \) is multiplied by \( \Phi (d_1) \).

\( K e^{-rT} \Phi (d_2) \): This term does not depend on \( S \), so its derivative w.r.t. \( S \) is 0.

3. Differentiate \( S \Phi (d_1) \) The derivative of \( S \Phi (d_1) \) has two components:

\( \Phi (d_1) \): Cumulative distribution of \( d_1 \), which depends on \( S \).

\( d_1 \) is:

4. Simplify \( \frac{\partial d_1}{\partial S} \) From \( d_1 \):

5. Substituting back:

Simplify further:

6. Solve for Call Option Delta:

The derivative of \( C \) with respect to \( S \) is:

Put Option Delta#

1. Put Option Price

Key Intuition#

What happens when we subtract the put delta from the call delta?

Question 3: What Is The “Pareto Range” Predicted By The Market Today?#

Also: What Do I Mean By “Pareto Range”?

Brief Note On Data Sources

Raw data is available from a variety of sources:

Option prices: WRDS, OptionMetrics, Barchart, Bloomberg etc.

Futures: ICE / Chicago Mercantile Exchange, other data providers etc.

Answer:

Let’s look at the raw data for the option chain for a single trading day.

asof_date = "2025-02-12"

comdty = "brent"

comdty_root = COMDTY_CODES[comdty]

display_months = {"brent": 15, "wti": 15, "henry_hub": 12}

months_to_display = display_months[comdty]

heatmap_steps = {"brent": 3, "wti": 3, "henry_hub": 1}

interpolation_args = {

"brent": {"method": "cubic", "order": 3},

"wti": {"method": "linear", "order": 1},

"henry_hub": {"method": "quadratic", "order": 3},

}

# get option chain for all commodities

options_data = hf.get_option_chain(comdty, asof_date=asof_date)

display(options_data)

print("Datapoints:", options_data.columns)

| symbol | root | contract | underlyingFuture | contractName | contractMonth | exchange | type | strike | expirationDate | date | impliedVolatility | delta | gamma | theta | vega | open | high | low | last | previousClose | change | percentChange | volume | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | CBJ300C | CB | CBJ25 | CBJ25 | Crude Oil Brent | J | ICE | Call | 30.0 | 2025-02-25 | 2025-02-12 | 2.1220 | 0.9922 | 0.0006 | -0.0152 | 0.0025 | 45.18 | 45.18 | 45.18 | 45.18 | 47.00 | -1.82 | -3.872340 | 0 |

| 1 | CBJ300P | CB | CBJ25 | CBJ25 | Crude Oil Brent | J | ICE | Put | 30.0 | 2025-02-25 | 2025-02-12 | 1.7127 | -0.0013 | 0.0002 | -0.0041 | 0.0006 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.000000 | 0 |

| 2 | CBJ350C | CB | CBJ25 | CBJ25 | Crude Oil Brent | J | ICE | Call | 35.0 | 2025-02-25 | 2025-02-12 | 1.7624 | 0.9916 | 0.0008 | -0.0136 | 0.0027 | 40.18 | 40.18 | 40.18 | 40.18 | 42.00 | -1.82 | -4.333333 | 0 |

| 3 | CBJ350P | CB | CBJ25 | CBJ25 | Crude Oil Brent | J | ICE | Put | 35.0 | 2025-02-25 | 2025-02-12 | 1.4393 | -0.0016 | 0.0003 | -0.0040 | 0.0007 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.000000 | 0 |

| 4 | CBJ375C | CB | CBJ25 | CBJ25 | Crude Oil Brent | J | ICE | Call | 37.5 | 2025-02-25 | 2025-02-12 | 1.6021 | 0.9914 | 0.0009 | -0.0128 | 0.0028 | 37.68 | 37.68 | 37.68 | 37.68 | 39.50 | -1.82 | -4.607595 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 8691 | CBZ720T | CB | CBZ29 | CBZ29 | Crude Oil Brent | Z | ICE | Put | 72.0 | 2029-10-26 | 2025-02-12 | 0.2831 | -0.3388 | 0.0076 | -0.0020 | 0.4678 | 15.46 | 15.46 | 15.46 | 15.46 | 15.28 | 0.18 | 1.178010 | 0 |

| 8692 | CBZ730G | CB | CBZ29 | CBZ29 | Crude Oil Brent | Z | ICE | Call | 73.0 | 2029-10-26 | 2025-02-12 | 0.2639 | 0.4588 | 0.0083 | -0.0023 | 0.4723 | 10.95 | 10.95 | 10.95 | 10.95 | 11.30 | -0.35 | -3.097345 | 0 |

| 8693 | CBZ730T | CB | CBZ29 | CBZ29 | Crude Oil Brent | Z | ICE | Put | 73.0 | 2029-10-26 | 2025-02-12 | 0.2840 | -0.3456 | 0.0076 | -0.0020 | 0.4698 | 16.04 | 16.04 | 16.04 | 16.04 | 15.85 | 0.19 | 1.198738 | 0 |

| 8694 | CBZ740G | CB | CBZ29 | CBZ29 | Crude Oil Brent | Z | ICE | Call | 74.0 | 2029-10-26 | 2025-02-12 | 0.2612 | 0.4498 | 0.0084 | -0.0023 | 0.4743 | 10.55 | 10.55 | 10.55 | 10.55 | 10.89 | -0.34 | -3.122130 | 0 |

| 8695 | CBZ740T | CB | CBZ29 | CBZ29 | Crude Oil Brent | Z | ICE | Put | 74.0 | 2029-10-26 | 2025-02-12 | 0.2852 | -0.3520 | 0.0076 | -0.0019 | 0.4715 | 16.64 | 16.64 | 16.64 | 16.64 | 16.44 | 0.20 | 1.216545 | 0 |

8696 rows × 24 columns

Datapoints: Index(['symbol', 'root', 'contract', 'underlyingFuture', 'contractName',

'contractMonth', 'exchange', 'type', 'strike', 'expirationDate', 'date',

'impliedVolatility', 'delta', 'gamma', 'theta', 'vega', 'open', 'high',

'low', 'last', 'previousClose', 'change', 'percentChange', 'volume'],

dtype='object')

–> For the homework, you will need the the option chain for SPX options.

–> You will also need the term structure of futures for the underlying security (SPX for the homework)

futures_data = hf.get_futures(ticker="CY", asof_date=asof_date)

display(futures_data)

print("Datapoints:", futures_data.columns)

| comdty_code | comdty_name | comdty_desc | trade_date | contract_year | contract_month | contract_date | future_month_index | settle_price | comdty_unit | open_interest | volume | last_trade_date | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2025 | 2 | 2025-02-28 | 0 | 75.28 | $/Bbl | NaN | NaN | NaN |

| 1 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2025 | 3 | 2025-03-31 | 1 | 74.85 | $/Bbl | NaN | NaN | NaN |

| 2 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2025 | 4 | 2025-04-30 | 2 | 74.47 | $/Bbl | NaN | NaN | NaN |

| 3 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2025 | 5 | 2025-05-31 | 3 | 74.06 | $/Bbl | NaN | NaN | NaN |

| 4 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2025 | 6 | 2025-06-30 | 4 | 73.63 | $/Bbl | NaN | NaN | NaN |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 81 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2031 | 11 | 2031-11-30 | 81 | 67.64 | $/Bbl | NaN | NaN | NaN |

| 82 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2031 | 12 | 2031-12-31 | 82 | 67.63 | $/Bbl | NaN | NaN | NaN |

| 83 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2032 | 1 | 2032-01-31 | 83 | 67.62 | $/Bbl | NaN | NaN | NaN |

| 84 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2032 | 2 | 2032-02-29 | 84 | 67.62 | $/Bbl | NaN | NaN | NaN |

| 85 | CY | Brent Oil | Brent Financial Futures | 2025-02-12 | 2032 | 3 | 2032-03-31 | 85 | 67.62 | $/Bbl | NaN | NaN | NaN |

86 rows × 13 columns

Datapoints: Index(['comdty_code', 'comdty_name', 'comdty_desc', 'trade_date',

'contract_year', 'contract_month', 'contract_date',

'future_month_index', 'settle_price', 'comdty_unit', 'open_interest',

'volume', 'last_trade_date'],

dtype='object')

if asof_date is None:

asof_date = options_data["date"][0]

_ = hf.run_prediction_models(

comdty,

asof_date,

months_to_display=months_to_display,

heatmap_step=heatmap_steps[comdty],

interpolation_args=interpolation_args,

)

| Expiration Date | Feb 2025 | Mar 2025 | Apr 2025 | May 2025 | Jun 2025 | Jul 2025 | Aug 2025 | Sep 2025 | Oct 2025 | Nov 2025 | Dec 2025 | Jan 2026 | Feb 2026 | Mar 2026 | Apr 2026 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 80% Below | 78.00 | 81.00 | 83.00 | 84.50 | 86.00 | 87.00 | 88.00 | 89.00 | 90.00 | 91.00 | 92.00 | 93.0 | 94.00 | 95.00 | 95.00 |

| 50/50 | 75.50 | 75.00 | 75.00 | 75.00 | 74.50 | 74.50 | 74.00 | 74.00 | 74.00 | 73.50 | 73.50 | 73.5 | 73.50 | 73.50 | 73.50 |

| 80% Above | 72.00 | 69.50 | 67.50 | 65.75 | 64.50 | 63.00 | 61.50 | 60.50 | 59.50 | 58.50 | 57.50 | 57.0 | 56.50 | 55.50 | 55.00 |

| Strip 2025-02-12 | 75.28 | 74.85 | 74.47 | 74.06 | 73.63 | 73.19 | 72.78 | 72.41 | 72.07 | 71.74 | 71.44 | 71.2 | 70.98 | 70.79 | 70.62 |

| Expiration Date | Feb 2025 | Mar 2025 | Apr 2025 | May 2025 | Jun 2025 | Jul 2025 | Aug 2025 | Sep 2025 | Oct 2025 | Nov 2025 | Dec 2025 | Jan 2026 | Feb 2026 | Mar 2026 | Apr 2026 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Price >= | |||||||||||||||

| $200.00 | 1% | 3% | 4% | 5% | 6% | 8% | 9% | 10% | 11% | 11% | 12% | 13% | 14% | 15% | 15% |

| $160.00 | 2% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 11% | 11% | 12% | 13% | 13% | 14% | |

| $140.00 | 2% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 10% | 11% | 12% | 12% | 13% | 14% | |

| $125.00 | 2% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 11% | 11% | 12% | 13% | 13% | 14% | |

| $116.00 | 2% | 4% | 5% | 7% | 8% | 9% | 10% | 11% | 11% | 12% | 13% | 13% | 14% | 14% | |

| $113.00 | 2% | 4% | 5% | 7% | 8% | 9% | 10% | 11% | 12% | 12% | 13% | 13% | 14% | 14% | |

| $110.00 | 3% | 4% | 6% | 7% | 9% | 9% | 10% | 11% | 12% | 13% | 13% | 14% | 14% | 15% | |

| $107.00 | 3% | 5% | 6% | 8% | 9% | 10% | 11% | 12% | 12% | 13% | 14% | 14% | 15% | 15% | |

| $104.00 | 1% | 3% | 5% | 7% | 8% | 9% | 11% | 11% | 12% | 13% | 14% | 15% | 15% | 16% | 16% |

| $101.00 | 1% | 3% | 5% | 7% | 9% | 10% | 11% | 12% | 13% | 14% | 15% | 16% | 16% | 17% | 17% |

| $98.00 | 1% | 4% | 6% | 8% | 10% | 11% | 12% | 13% | 15% | 15% | 16% | 17% | 17% | 18% | 19% |

| $95.00 | 1% | 4% | 7% | 9% | 11% | 13% | 14% | 15% | 16% | 17% | 18% | 19% | 19% | 20% | 20% |

| $92.00 | 1% | 5% | 8% | 11% | 13% | 15% | 16% | 17% | 18% | 19% | 20% | 21% | 21% | 22% | 23% |

| $89.00 | 2% | 7% | 11% | 14% | 16% | 18% | 19% | 20% | 21% | 22% | 23% | 24% | 24% | 25% | 25% |

| $86.00 | 3% | 9% | 14% | 17% | 20% | 22% | 23% | 24% | 25% | 26% | 26% | 27% | 28% | 28% | 29% |

| $84.00 | 3% | 12% | 18% | 21% | 23% | 25% | 26% | 27% | 28% | 29% | 29% | 30% | 30% | 31% | 32% |

| $82.50 | 5% | 16% | 21% | 24% | 26% | 28% | 29% | 30% | 31% | 31% | 32% | 33% | 33% | 33% | 34% |

| $81.00 | 8% | 20% | 25% | 28% | 30% | 31% | 32% | 33% | 34% | 34% | 34% | 35% | 35% | 36% | 36% |

| $79.50 | 12% | 26% | 31% | 33% | 34% | 35% | 36% | 36% | 37% | 37% | 37% | 38% | 38% | 38% | 39% |

| $78.00 | 22% | 33% | 37% | 38% | 39% | 39% | 39% | 40% | 40% | 40% | 40% | 41% | 41% | 41% | 41% |

| $77.00 | 30% | 39% | 41% | 42% | 42% | 42% | 42% | 42% | 42% | 42% | 42% | 43% | 43% | 43% | 43% |

| $76.00 | 41% | 45% | 45% | 45% | 45% | 45% | 45% | 45% | 45% | 45% | 45% | 45% | 45% | 45% | 45% |

| $74.50 | 59% | 54% | 52% | 51% | 50% | 49% | 49% | 49% | 48% | 48% | 48% | 48% | 48% | 48% | 48% |

| $73.00 | 74% | 63% | 59% | 57% | 55% | 54% | 53% | 52% | 52% | 52% | 51% | 51% | 51% | 51% | 51% |

| $71.50 | 85% | 71% | 66% | 62% | 60% | 59% | 57% | 56% | 56% | 55% | 55% | 54% | 54% | 54% | 54% |

| $70.00 | 91% | 78% | 72% | 68% | 65% | 63% | 61% | 60% | 59% | 59% | 58% | 57% | 57% | 57% | 57% |

| $68.50 | 95% | 83% | 77% | 73% | 70% | 67% | 65% | 64% | 63% | 62% | 61% | 61% | 60% | 60% | 59% |

| $67.50 | 96% | 86% | 80% | 75% | 72% | 70% | 68% | 66% | 65% | 64% | 63% | 63% | 62% | 62% | 61% |

| $66.75 | 97% | 88% | 82% | 77% | 74% | 72% | 70% | 68% | 67% | 66% | 65% | 64% | 64% | 63% | 63% |

| $66.00 | 98% | 90% | 84% | 79% | 76% | 73% | 71% | 70% | 68% | 67% | 66% | 66% | 65% | 64% | 64% |

| $65.00 | 98% | 91% | 86% | 82% | 78% | 76% | 74% | 72% | 70% | 69% | 68% | 67% | 67% | 66% | 66% |

| $63.50 | 99% | 93% | 88% | 85% | 82% | 79% | 77% | 75% | 73% | 72% | 71% | 70% | 69% | 69% | 68% |

| $62.20 | 95% | 90% | 87% | 84% | 81% | 79% | 77% | 76% | 74% | 73% | 72% | 72% | 71% | 70% | |

| $61.00 | 95% | 92% | 89% | 86% | 83% | 81% | 79% | 78% | 76% | 75% | 74% | 74% | 73% | 72% | |

| $59.50 | 96% | 93% | 90% | 88% | 85% | 83% | 81% | 80% | 79% | 78% | 77% | 76% | 75% | 74% | |

| $58.00 | 97% | 94% | 92% | 89% | 87% | 85% | 84% | 82% | 81% | 80% | 79% | 78% | 77% | 76% | |

| $56.50 | 97% | 95% | 93% | 91% | 89% | 87% | 85% | 84% | 83% | 82% | 81% | 80% | 79% | 78% | |

| $55.00 | 98% | 96% | 94% | 92% | 90% | 88% | 87% | 85% | 84% | 83% | 82% | 82% | 81% | 80% | |

| $52.20 | 98% | 96% | 95% | 93% | 92% | 90% | 89% | 88% | 87% | 86% | 85% | 84% | 84% | 83% | |

| $50.00 | 98% | 97% | 96% | 94% | 93% | 92% | 91% | 89% | 89% | 88% | 87% | 86% | 85% | 85% | |

| $47.00 | 98% | 97% | 96% | 95% | 94% | 93% | 92% | 91% | 90% | 90% | 89% | 88% | 88% | 87% | |

| $44.00 | 99% | 98% | 97% | 96% | 95% | 94% | 93% | 92% | 92% | 91% | 90% | 90% | 89% | 89% | |

| $41.00 | 99% | 98% | 97% | 96% | 96% | 95% | 94% | 93% | 93% | 92% | 92% | 91% | 91% | 90% | |

| $38.00 | 99% | 98% | 97% | 97% | 96% | 95% | 95% | 94% | 94% | 93% | 93% | 92% | 92% | 91% | |

| $36.00 | 99% | 98% | 97% | 97% | 96% | 96% | 95% | 95% | 94% | 94% | 93% | 93% | 92% | 92% | |

| $33.00 | 99% | 98% | 98% | 97% | 97% | 96% | 96% | 95% | 95% | 94% | 94% | 93% | 93% | 93% | |

| $30.00 | 99% | 98% | 98% | 97% | 97% | 96% | 96% | 96% | 95% | 95% | 94% | 94% | 94% | 93% |

Let’s Discuss These Charts…#

Progress Check: What Have We Done So Far?#

☑ Modeled an E&P as a long position in Brent oil futures (CME: CY).

☑ Working with real option prices & futures data for Brent oil.

☑ Use option delta to approximate the probability of an option expiring in-the-money.

☐ Validate option pricing models using Monte Carlo simulation of Brent futures with implied volatility.

☐ Use option delta to define acceptable risk ranges for the hedging program (e.g., 80% probability of options expiring worthless).

☐ Design a hedging strategy to lock in a price floor for oil using put options.

☐ Attempt to make the hedge costless by selling call options (i.e., constructing a costless collar).

The Sanity Check: Validating The Option Market#

Why Do We Care About Validating the Option Market?#

The market is often prone to periods of excitement, fear, and uncertainty.

At any given point in time, the prices of options will reflect the views of all market participants in aggregate.

You could place a hedging trade at a time of high volatility, and sacrifice potential hedging returns if volatility drops. Why?

Validating market prices against some kind of theoretical benchmark can provide insight into:

Is this a good time to hedge? i.e. are prices chaotic or stable?

Are there opportunities for arbitrage?

3-Step Approach To Validation:#

Step 1: Build The Volatility Surface#

options_data = hf.get_option_chain(comdty, asof_date)

# add a columns of time remaining to expiration in years, relative to asof_date

options_data = options_data.assign(

time_to_expiry=(

options_data["expirationDate"].apply(pd.to_datetime) - pd.to_datetime(asof_date)

).dt.days

/ 365

)

options_data.set_index(["time_to_expiry", "type", "strike"], inplace=True)

strip_pricing = hf.get_strip_pricing(asof_date)

# convert index to time-to-expiry

strip_pricing.index = hf.dates_to_time_remaining(strip_pricing.index, asof_date)

strip_pricing = strip_pricing.iloc[:months_to_display]

display_strip_pricing = strip_pricing.copy().to_frame()

display_strip_pricing.index = hf.time_remaining_to_dates(

display_strip_pricing.index, asof_date

).strftime("%b %Y")

display(

display_strip_pricing.T.style.set_caption(

f"Strip Pricing as of {asof_date}"

).format("{:.2f}")

)

| expirationDate | Feb 2025 | Mar 2025 | Apr 2025 | May 2025 | Jun 2025 | Jul 2025 | Aug 2025 | Sep 2025 | Oct 2025 | Nov 2025 | Dec 2025 | Jan 2026 | Feb 2026 | Mar 2026 | Apr 2026 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Strip | 75.28 | 74.85 | 74.47 | 74.06 | 73.63 | 73.19 | 72.78 | 72.41 | 72.07 | 71.74 | 71.44 | 71.20 | 70.98 | 70.79 | 70.62 |

Step 1a: Build the Volatility Surface for OTM Puts#

puts, put_iv_surface = hf.build_put_iv_surface(options_data, strip_pricing)

put_price_surface = hf.build_put_price_surface(options_data, strip_pricing)

hf.plot_vol_price_charts(

iv_surface=put_iv_surface,

price_surface=put_price_surface,

strike_range=[

np.floor(put_iv_surface.index.min()),

np.ceil(put_iv_surface.index.max()),

],

expiry_range=[put_iv_surface.columns.min(), put_iv_surface.columns.max()],

iv_surface_title="Put Implied Volatility Surface",

price_surface_title="Put Price Surface",

)

Step 1b: Build the Volatility Surface for Calls#

calls, call_iv_surface = hf.build_call_iv_surface(options_data, strip_pricing)

call_price_surface = hf.build_call_price_surface(options_data, strip_pricing)

hf.plot_vol_price_charts(

iv_surface=call_iv_surface,

price_surface=call_price_surface,

strike_range=[

np.floor(call_iv_surface.index.min()),

np.ceil(call_iv_surface.index.max()),

],

expiry_range=[call_iv_surface.columns.min(), call_iv_surface.columns.max()],

iv_surface_title="Call Implied Volatility Surface",

price_surface_title="Call Price Surface",

)

Step 1c: Build The Complete Volatility Surface#

iv_surface = hf.build_full_iv_surface(

put_iv_surface, call_iv_surface, strike_range=(35, 150), expiry_range=(0.01, 2.0)

)

price_surface = hf.build_full_price_surface(

put_price_surface,

call_price_surface,

strike_range=(35, 150),

expiry_range=(0.01, 2.0),

)

hf.plot_vol_price_charts(

iv_surface=iv_surface,

price_surface=price_surface,

strike_range=[np.floor(iv_surface.index.min()), np.ceil(iv_surface.index.max())],

expiry_range=[iv_surface.columns.min(), iv_surface.columns.max()],

iv_surface_title="Brent Oil Implied Volatility Surface",

price_surface_title="Brent Oil Price Surface",

)

Step 2: Simulate How The Futures Might Move (Based on IV Surface)#

OptiQuant’s approach to simulating Brent futures involves a random simulation of each Brent futures contract.

We simulate the movement of the futures strip using GBM (Geometric Brownian Motion) with constant drift equal to the long-term risk-free rate, and dynamic volatility, based on the current market implied volatility surface.

Updating the simulated volatility dynamically at each step ensures that as simulated prices move away from the current price level, subsequent simulated prices incorporate the volatility that the market is using to price options at that level.

Concrete Example

In concrete terms, assume we are simulating the February 2025 Brent oil futures contract, which settled at $78.50 on a particular date (say, January 13, 2025). This contract will continue trading until January 31, 2025.

We reference the option chain as of this date, and look for the option contract (call or put) with a strike price closest to $78.50, and extract the implied volatility (IV) of this option from the IV surface (say, 28% annualized).

This IV is then used as the starting volatility term in the random simulation, which needs to be run until the contract expiration, or (31 - 13) = 18 days.

For each iteration (each day) of the random simulation, the IV term is updated based on the IV surface calculated earlier. e.g. If the second price in the simulation is $81.54, the model updates the IV based on the option with the nearest strike price, which could be higher, lower, or equal to 28%.

This approach allows the simulated prices movement to mimic the volatility of actual prices as they deviate further from the current price level (the strip). For instance, option prices significantly higher than the current price level typically exhibit higher volatility (higher likelihood of changing up or down).

# print(comdty_code)

comdty_code = "CY"

r = 0.045

N = 500

dt = 1 / 365.0

show_charts = False

simulated_futures = hf.build_simulated_futures(

asof_date,

strip_pricing,

iv_surface,

months_to_display,

comdty_code,

r,

N,

dt,

show_charts,

)

| Feb 2025 | Mar 2025 | Apr 2025 | May 2025 | Jun 2025 | Jul 2025 | Aug 2025 | Sep 2025 | Oct 2025 | Nov 2025 | Dec 2025 | Jan 2026 | Feb 2026 | Mar 2026 | Apr 2026 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10% | 71.38 | 66.94 | 64.80 | 62.88 | 60.73 | 59.17 | 57.69 | 54.76 | 54.70 | 53.85 | 52.51 | 52.18 | 51.08 | 48.80 | 48.96 |

| 20% | 72.83 | 70.48 | 68.71 | 66.42 | 65.66 | 64.36 | 63.15 | 62.39 | 60.21 | 59.57 | 59.02 | 58.93 | 57.77 | 58.50 | 57.90 |

| 30% | 74.13 | 72.26 | 70.94 | 70.34 | 69.08 | 68.17 | 66.67 | 66.37 | 65.29 | 64.51 | 63.72 | 64.24 | 64.25 | 63.70 | 63.29 |

| 40% | 74.88 | 74.16 | 73.11 | 73.14 | 72.08 | 71.20 | 70.94 | 70.06 | 69.49 | 69.57 | 69.53 | 68.82 | 69.05 | 69.93 | 69.24 |

| 50% | 75.43 | 75.43 | 75.22 | 75.37 | 74.89 | 74.23 | 74.31 | 73.46 | 73.33 | 73.52 | 74.26 | 74.38 | 74.44 | 74.47 | 73.99 |

| 60% | 76.30 | 77.24 | 77.44 | 77.98 | 77.71 | 77.76 | 77.55 | 76.97 | 77.41 | 77.83 | 78.76 | 78.68 | 79.34 | 79.43 | 79.89 |

| 70% | 77.58 | 78.85 | 79.78 | 80.83 | 80.74 | 81.19 | 81.56 | 82.41 | 81.73 | 82.68 | 83.42 | 84.12 | 84.66 | 85.11 | 83.77 |

| 80% | 78.56 | 81.36 | 82.87 | 84.24 | 84.02 | 86.33 | 86.34 | 86.21 | 87.58 | 88.62 | 89.00 | 90.33 | 91.39 | 91.67 | 92.34 |

| 90% | 80.16 | 83.74 | 86.43 | 89.05 | 90.47 | 93.02 | 94.26 | 95.28 | 95.84 | 97.87 | 99.48 | 99.84 | 101.42 | 103.49 | 105.53 |

| Strip Feb 12, 2025 | 75.28 | 74.85 | 74.47 | 74.06 | 73.63 | 73.19 | 72.78 | 72.41 | 72.07 | 71.74 | 71.44 | 71.20 | 70.98 | 70.79 | 70.62 |

Step 3: Choosing Risk Ranges And Constructing The Costless Collar#

Now that we have a volatility surface and a MC simulation of the futures curve, we can examine the market pricing of options, and determine what floor/ceiling combination might be costless, based on the prior day’s closing prices.

For instance, say we want a collar that has a floor put price at the 20th percentile level (meaning there is an 80% chance the price will be above this level), we want to be able to answer the question:

What is the ceiling (call) strike price that would completely offset the cost of this floor?

We introduce the input parameter

deltaord,0% < d < 100%, which gives us the collar strike range of(d, 1-d). Ifd = 0.80, this would result in the model finding80/20collars.

# enter the range of costless collar to construct

d = 0.80

print(f"Constructing a {d:.0%} / {(1 - d):.0%} collar...")

# build the delta map

delta_map = hf.build_delta_map(

comdty,

asof_date,

months_to_display,

show_detail=False,

weighted=False,

interpolate_missing=True,

interpolation_args=interpolation_args,

)

# simulate a range of futures, including the collar strike %iles

default_percentiles = np.unique(

np.round(np.sort(np.append(np.arange(0.1, 1.0, 0.1), np.array([d, 1 - d]))), 3)

)

simulated_futures = hf.simulate_futures(

asof_date,

strip_pricing,

iv_surface,

r,

N,

dt,

default_percentiles=default_percentiles,

show_charts=True,

random_seed=123,

)

collar_strikes, costless_collars = hf.show_collar_strikes(

d,

delta_map,

sim_d=simulated_futures.loc[:, [f"{d:.0%}", f"{1 - d:.0%}"]],

months_to_display=months_to_display,

asof_date=asof_date,

options_data=options_data,

)

simulated_futures.index = collar_strikes.index

display(simulated_futures)

Constructing a 80% / 20% collar...

Simulated 500 paths for each contract.

| expirationDate | Feb 2025 | Mar 2025 | Apr 2025 | May 2025 | Jun 2025 | Jul 2025 | Aug 2025 | Sep 2025 | Oct 2025 | Nov 2025 | Dec 2025 | Jan 2026 | Feb 2026 | Mar 2026 | Apr 2026 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 80% Above | 72.00 | 69.50 | 67.50 | 65.75 | 64.50 | 63.00 | 61.50 | 60.50 | 59.50 | 58.50 | 57.50 | 57.00 | 56.50 | 55.50 | 55.00 |

| 80% Below | 78.00 | 81.00 | 83.00 | 84.50 | 86.00 | 87.00 | 88.00 | 89.00 | 90.00 | 91.00 | 92.00 | 93.00 | 94.00 | 95.00 | 95.00 |

| Strip 2025-02-12 | 75.28 | 74.85 | 74.47 | 74.06 | 73.63 | 73.19 | 72.78 | 72.41 | 72.07 | 71.74 | 71.44 | 71.20 | 70.98 | 70.79 | 70.62 |

| Sim. 80% Below | 78.56 | 81.36 | 82.87 | 84.24 | 84.02 | 86.33 | 86.34 | 86.21 | 87.58 | 88.62 | 89.00 | 90.33 | 91.39 | 91.67 | 92.34 |

| Sim. 80% Above | 72.83 | 70.48 | 68.71 | 66.42 | 65.66 | 64.36 | 63.15 | 62.39 | 60.21 | 59.57 | 59.02 | 58.93 | 57.77 | 58.50 | 57.90 |

| Costless Ceiling | 78.25 | 80.25 | 81.50 | 82.50 | 83.00 | 83.50 | 84.00 | 84.00 | 85.00 | 85.00 | 85.00 | 85.00 | 85.00 | 86.00 | 86.00 |

Net cost to hedge this set of collars: $-0.1744 per unit

| 10% | 20% | 30% | 40% | 50% | 60% | 70% | 80% | 90% | Strip Feb 12, 2025 | |

|---|---|---|---|---|---|---|---|---|---|---|

| expirationDate | ||||||||||

| 2025-02-28 | 71.379094 | 72.825174 | 74.134577 | 74.878101 | 75.430168 | 76.296540 | 77.579305 | 78.557496 | 80.160857 | 75.28 |

| 2025-03-31 | 66.937800 | 70.477027 | 72.260282 | 74.159977 | 75.428330 | 77.241394 | 78.850137 | 81.362605 | 83.737875 | 74.85 |

| 2025-04-30 | 64.797561 | 68.708870 | 70.942801 | 73.107408 | 75.223887 | 77.435859 | 79.781431 | 82.874273 | 86.431671 | 74.47 |

| 2025-05-31 | 62.876772 | 66.421266 | 70.337121 | 73.141116 | 75.365317 | 77.975081 | 80.827868 | 84.239332 | 89.054495 | 74.06 |

| 2025-06-30 | 60.725351 | 65.656283 | 69.075033 | 72.080864 | 74.891073 | 77.713527 | 80.741445 | 84.023633 | 90.474317 | 73.63 |

| 2025-07-31 | 59.165076 | 64.355567 | 68.170206 | 71.203229 | 74.226871 | 77.761902 | 81.192160 | 86.334046 | 93.021304 | 73.19 |

| 2025-08-31 | 57.693126 | 63.147342 | 66.673310 | 70.943460 | 74.306176 | 77.545568 | 81.555787 | 86.337948 | 94.256635 | 72.78 |

| 2025-09-30 | 54.762583 | 62.386986 | 66.374435 | 70.063353 | 73.456499 | 76.973765 | 82.407582 | 86.212229 | 95.282402 | 72.41 |

| 2025-10-31 | 54.703766 | 60.213351 | 65.293407 | 69.492364 | 73.330841 | 77.413429 | 81.728641 | 87.581267 | 95.839160 | 72.07 |

| 2025-11-30 | 53.852547 | 59.566410 | 64.509451 | 69.568351 | 73.519697 | 77.826186 | 82.677539 | 88.620497 | 97.874232 | 71.74 |

| 2025-12-31 | 52.505464 | 59.024084 | 63.720932 | 69.531369 | 74.260043 | 78.761889 | 83.416040 | 89.001480 | 99.477889 | 71.44 |

| 2026-01-31 | 52.176485 | 58.927096 | 64.236250 | 68.821635 | 74.377319 | 78.680053 | 84.122267 | 90.327333 | 99.843355 | 71.20 |

| 2026-02-28 | 51.075377 | 57.770442 | 64.248535 | 69.045639 | 74.441590 | 79.337305 | 84.659765 | 91.393049 | 101.417936 | 70.98 |

| 2026-03-31 | 48.803071 | 58.503448 | 63.695273 | 69.933655 | 74.465134 | 79.430355 | 85.114858 | 91.674819 | 103.491047 | 70.79 |

| 2026-04-30 | 48.961675 | 57.900187 | 63.294155 | 69.244239 | 73.987508 | 79.885094 | 83.766358 | 92.338069 | 105.530672 | 70.62 |

Progress Check: What Did We Just Do?#

☑ Modeled an E&P as a long position in Brent oil futures (CME: CY).

☑ Working with real option prices & futures data for Brent oil.

☑ Use option delta to approximate the probability of an option expiring in-the-money.

☑ Validate option pricing models using Monte Carlo simulation of Brent futures with implied volatility.

☑ Use option delta to define acceptable risk ranges for the hedging program (e.g., 80% probability of options expiring worthless).

☑ Design a hedging strategy to lock in a price floor for oil using put options.

☑ Attempt to make the hedge costless by selling call options (i.e., constructing a costless collar).

Bridge to SPX Options Homework#

Assume client has a long SPX position

You will pull the option chain for SPX from WRDS (code will be provided for the raw data pull).

You will construct dataframes that work with the charting functions provided.

You will output a dashboard that allows the user to select a risk range desired for the costless collar hedge, and returns the strikes available.