Databento#

What Is Databento?#

Databento is an API-first market data platform that provides programmatic access to exchange-level tick data, order book snapshots, and OHLCV bars. Unlike Bloomberg (which centers on a desktop terminal) or LSEG Datastream (which is accessed via WRDS web queries), Databento is designed from the ground up for developers and quantitative researchers who want to pull data directly into code.

Key differentiators:

Programmatic access: Python SDK, HTTP API, and raw TCP — no terminal or GUI required.

Exchange-level granularity: Tick-by-tick trades, L2/L3 order book, and time-bar aggregations from 1-second to daily.

Pay-as-you-go pricing: Check the exact dollar cost of any query before executing it, for free.

Self-service: No sales calls or license negotiations.

UChicago has a Databento subscription for FINM students, providing access to CME Globex (GLBX.MDP3) — the electronic trading venue for E-mini S&P 500 futures, Treasury futures, and other major derivatives.

Discussion

How does the pricing model for Databento (pay-per-query) compare to Bloomberg (terminal subscription) and LSEG Datastream via WRDS (institutional license)? What are the implications for a research project that requires one-time bulk historical pulls versus ongoing daily updates?

Key Concepts: Datasets, Schemas, and Symbology#

Before writing any code, it helps to understand three organizing concepts in the Databento data model.

Datasets#

A dataset identifies a trading venue. The primary dataset for this course is:

Dataset |

Venue |

Products |

|---|---|---|

|

CME Globex |

E-mini S&P 500, Treasury futures, Eurodollars, and more |

Symbology#

Databento supports multiple ways to refer to the same instrument. This flexibility is essential when working with futures, which have expiring contracts:

Symbology Type |

Example |

Description |

|---|---|---|

|

|

One specific contract (ES = E-mini S&P, U = Sep, 4 = 2024) |

|

|

All active expirations of a product |

|

|

Rolling front-month contract |

|

|

Numeric exchange-assigned ID |

For quick reference, here are the futures month codes:

Code |

Month |

Code |

Month |

|---|---|---|---|

F |

January |

N |

July |

G |

February |

Q |

August |

H |

March |

U |

September |

J |

April |

V |

October |

K |

May |

X |

November |

M |

June |

Z |

December |

Schemas#

A schema controls the level of detail (and volume) of the data returned. Schemas form a hierarchy from most to least granular:

Schema |

Description |

|---|---|

|

Market-by-order (every order book event) |

|

Market-by-price, 10 levels |

|

Market-by-price, top of book |

|

Every individual trade (tick-by-tick) |

|

1-second bars |

|

1-minute bars |

|

1-hour bars |

|

Daily bars |

More granular schemas produce more data (and cost more). For most research

projects, trades or ohlcv-1m are good starting points.

See the

05_schemas_and_symbology

module in the examples repo for runnable comparisons.

Getting Started with the Python SDK#

Installation#

pip install databento python-dotenv

API Key Setup#

Create a .env file in your project root with your Databento API key:

DATABENTO_API_KEY=db-XXXXXXXXXXXXXXXXXXXX

Warning

Never commit your .env file to version control. Make sure .env is in your

.gitignore.

Your First Query#

The pattern for every historical query is: create client → check cost → fetch data → convert to DataFrame.

from dotenv import load_dotenv

import databento as db

load_dotenv() # reads DATABENTO_API_KEY from .env

client = db.Historical()

# --- Query parameters ---

query = dict(

dataset="GLBX.MDP3",

symbols=["ES.FUT"],

stype_in="parent",

schema="trades",

start="2024-08-01",

end="2024-08-02",

limit=10,

)

# Step 1: Check cost (free metadata call)

cost = client.metadata.get_cost(**query)

print(f"Estimated cost: ${cost:.4f}")

# Step 2: Fetch data only if the cost is acceptable

data = client.timeseries.get_range(**query)

# Step 3: Convert to pandas DataFrame

df = data.to_df()

print(df)

Warning

Always check client.metadata.get_cost() before calling get_range().

Queries against tick-level schemas over long time ranges or many symbols can

become expensive. The cost check is free and returns the exact dollar amount.

Historical vs. Live Data#

Databento provides two modes of access:

Historical: Pull archived data for backtesting and research via

db.Historical(). Billed per query based on data volume.Live: Stream real-time data as it arrives from the exchange via

db.Live(). Billed per subscription.

Here is a minimal live streaming example:

import databento as db

from dotenv import load_dotenv

load_dotenv()

client = db.Live()

client.subscribe(

dataset="GLBX.MDP3",

schema="trades",

stype_in="parent",

symbols="ES.FUT",

)

for record in client:

print(record) # each record is a TradeMsg with auto-scaled prices

Note

Live streaming requires CME Globex to be open (Sunday 5 PM – Friday 4 PM CT).

For a deeper look at what the SDK does under the hood (raw HTTP requests, TCP

connections, CRAM authentication), see modules

02_historical_api

and

04_live_raw_tcp

in the examples repo.

Case Study: Treasury Futures Market Brief#

The

06_treasury_futures_brief

example in the class repo fetches daily OHLCV data and open interest for five

Treasury futures products spanning the yield curve:

Symbol |

Product |

Underlying |

Approx. Duration |

|---|---|---|---|

|

2-Year T-Note |

UST 2Y |

~1.9 years |

|

5-Year T-Note |

UST 5Y |

~4.2 years |

|

10-Year T-Note |

UST 10Y |

~6.5 years |

|

Ultra 10-Year T-Note |

UST 10Y (ultra) |

~9.5 years |

|

30-Year T-Bond |

UST 30Y |

~17 years |

Indexed Price Series#

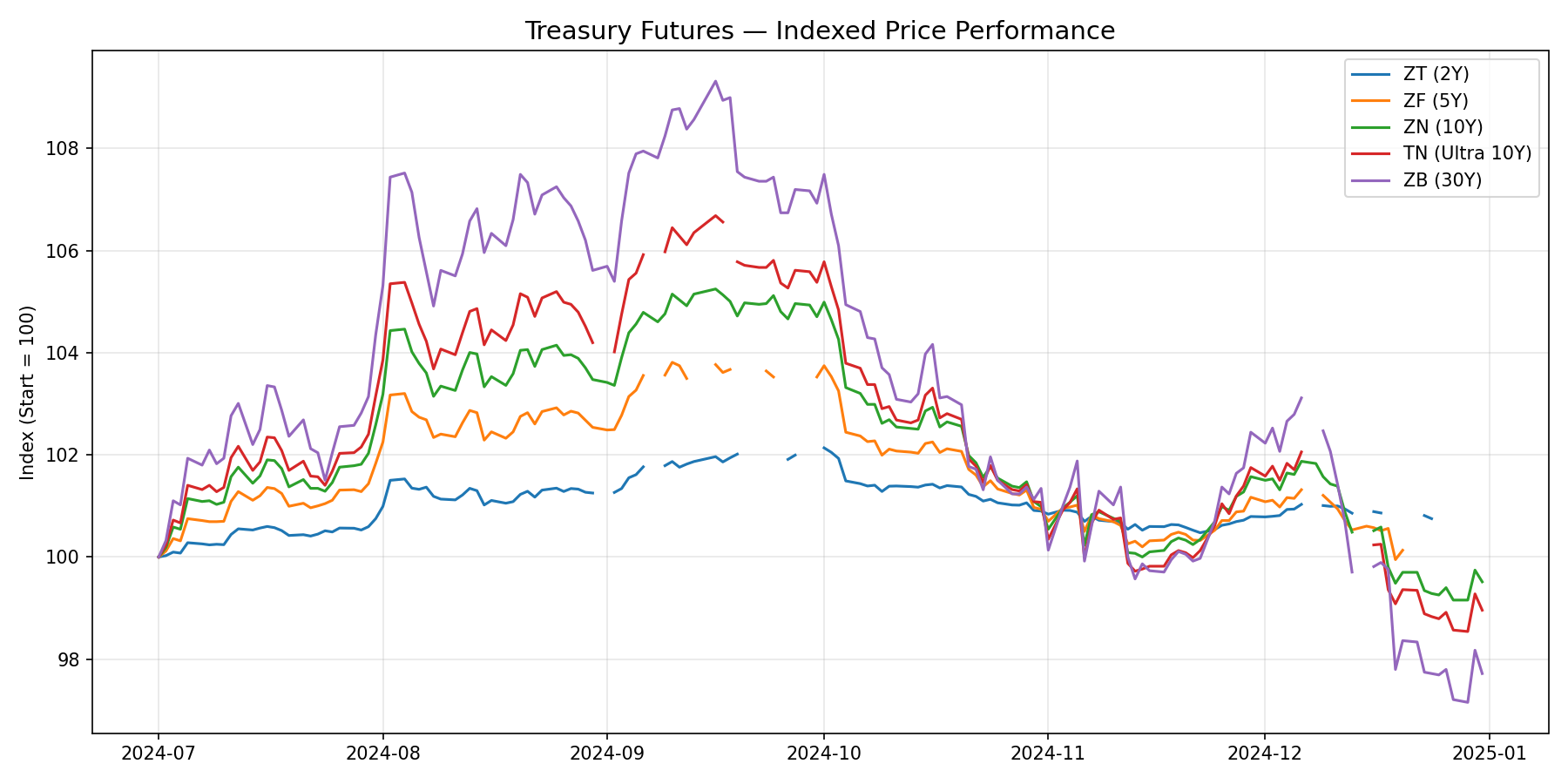

The chart below normalizes each product’s closing price to 100 at the start of the sample and tracks relative performance. Products with longer duration (ZB, TN) show larger price swings — exactly what we expect given the inverse relationship between bond prices and yields.

Fig. 4 Indexed closing prices (base = 100) for five Treasury futures products.#

Volume and Open Interest#

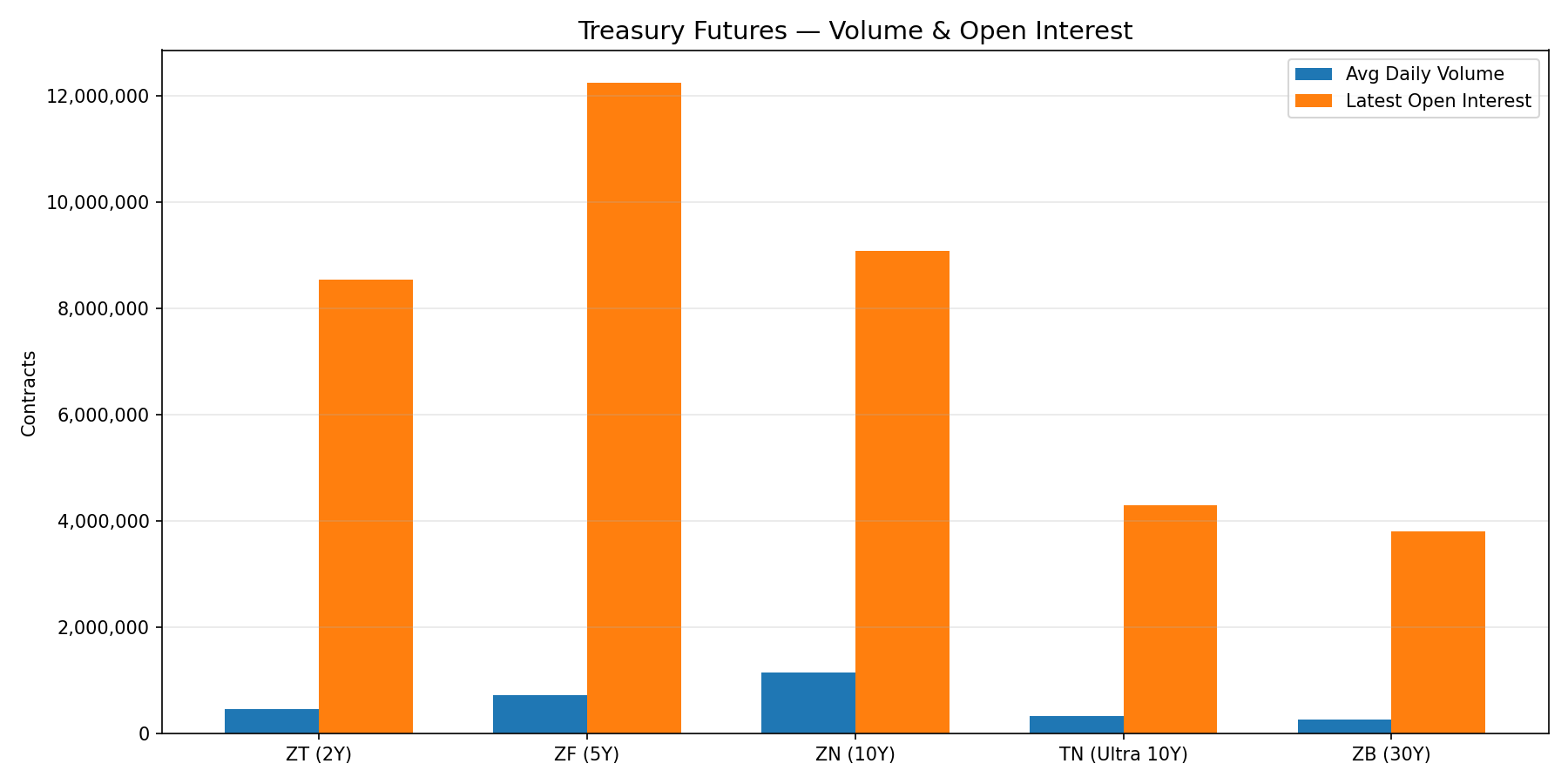

Volume and open interest reveal where liquidity concentrates. The 10-Year T-Note (ZN) typically dominates both metrics, making it the benchmark for Treasury futures trading.

Fig. 5 Average daily volume and open interest across Treasury futures products.#

Tip

Try it yourself. Clone the

examples repo

and run the 06_treasury_futures_brief scripts to reproduce these charts, add

new products, or extend the date range.

Comparing Data Sources#

Discussion

Bloomberg |

LSEG Datastream (WRDS) |

Databento |

|

|---|---|---|---|

Access |

Desktop terminal + Excel API |

Web queries or Python via WRDS |

Python SDK, HTTP API, TCP |

Pricing |

Annual terminal license |

Institutional license (via WRDS) |

Pay-per-query |

Strengths |

Breadth (equities, FI, macro, news) |

Long historical coverage, cross-asset |

Exchange-level tick data, order book |

Best for |

Exploratory research, fixed income analytics |

Panel data, academic research |

Algorithmic trading, microstructure research |

Resources#

Databento Documentation — API reference, schema definitions, dataset catalog

Databento Python SDK (PyPI) — SDK installation and changelog

FINM-32900 In-Class Examples: Databento — 6 modules covering historical/live access, schemas, symbology, and the Treasury futures case study

Databento Portal — Web UI for browsing datasets, checking costs, and managing API keys